Income Tax Refund Delay: Reasons, Status Check & What Taxpayers Should Do

Filing an Income Tax Return (ITR) often comes with one big expectation — receiving the refund on time. For many taxpayers, the refund arrives smoothly. But for others, the wait stretches longer than expected, leading to confusion, repeated portal checks, and unnecessary stress.

An income tax refund delay is not uncommon in India, especially during peak filing periods. The key is understanding why the refund is delayed, how to check its status correctly, and what actions taxpayers should take to resolve the issue without panic.

This article explains the entire process in simple terms, based on real filing experiences and practical tax compliance steps.

Why Income Tax Refund Gets Delayed

An income tax refund does not get delayed without a reason. In most cases, the delay is linked to verification, mismatches, or pending actions from the taxpayer’s side.

1. ITR Is Still Under Processing

After filing, every return goes through system checks and validation. During high-volume periods, especially close to deadlines, processing can take longer than usual.

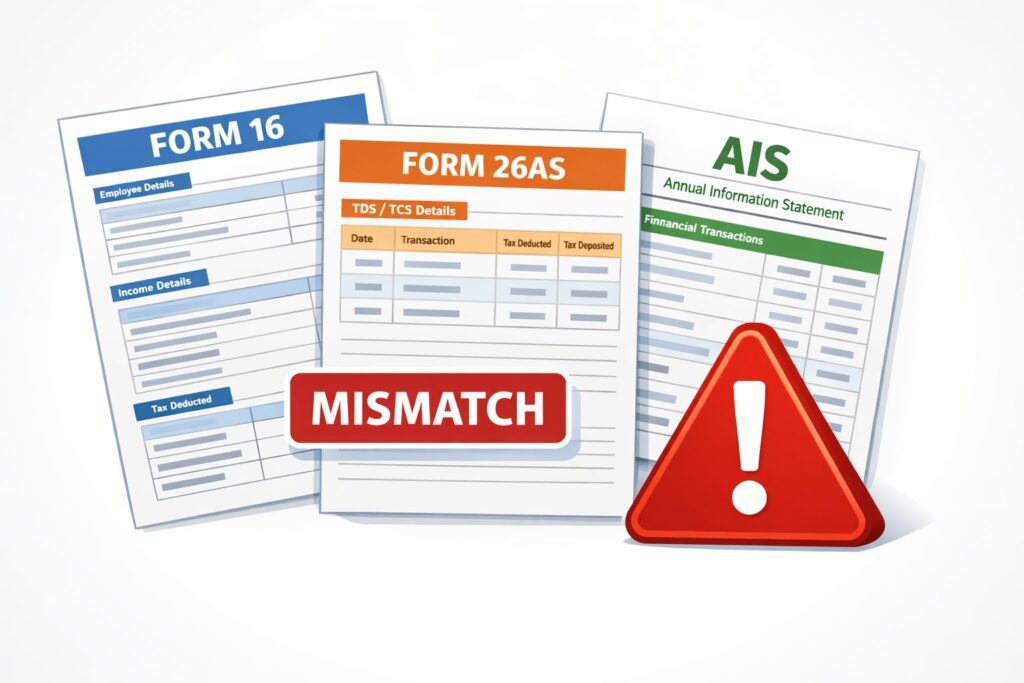

2. Mismatch in Income or TDS Details

One of the most common reasons for income tax refund delay is a mismatch between:

- Form 16

- Form 26AS

- Annual Information Statement (AIS)

Even a small difference in reported income or TDS can trigger additional verification, slowing down the refund.

3. ITR Not E-Verified

Many taxpayers overlook this step. Filing an ITR is incomplete unless it is e-verified within 30 days. Without verification, refund processing does not start.

LSI keywords: e-verify income tax return, ITR verification pending

4. Bank Account Not Pre-Validated

Refunds are credited only to pre-validated and PAN-linked bank accounts. Issues such as incorrect IFSC codes, inactive accounts, or failed validation can block the refund.

5. Outstanding Tax Demand from Previous Years

If there is any pending tax demand from earlier assessment years, the Income Tax Department may adjust the refund against those dues, resulting in delay or a reduced refund amount.

6. Defective Return or Notice Issued

In some cases, the return is marked as defective or a notice is issued seeking clarification. Until the taxpayer responds, the refund remains on hold.

How to Check Income Tax Refund Status Online

If your refund is delayed, the first step is to check its current status online.

Step-by-Step Process

- Log in to the official Income Tax e-Filing portal using PAN

- Go to e-File → Income Tax Returns → View Filed Returns

- Select the relevant assessment year

- Click on Refund Status

👉 Check your refund status directly here: Income Tax e-Filing Portal

The portal will show whether the refund is:

- Under processing

- Issued

- Failed

- Adjusted against demand

What Taxpayers Should Do If Refund Is Delayed

If your income tax refund has not arrived, avoid repeated speculation. Instead, follow these practical steps.

✔ Verify the Return Immediately

Confirm that your ITR is e-verified. If not, complete verification using Aadhaar OTP, net banking, or DSC.

✔ Recheck Bank Account Details

Ensure your bank account is:

- Pre-validated

- Linked with PAN

- Active and correct

✔ Check Portal Messages and Emails

Regularly review communication from the Income Tax Department for any notice or clarification request.

✔ Respond to Outstanding Tax Demand

If an old demand is visible, submit a response or explanation through the portal to unblock the refund.

How Long Does Income Tax Refund Take?

While timelines can vary, general timelines are:

- Normal cases: 2–6 weeks after e-verification

- Cases with mismatch or scrutiny: Longer, depending on response time

If the delay extends beyond this period, further action may be required.

When Should You File a Grievance?

If your refund is delayed for more than 45 days without any clear reason, you can raise a grievance through the grievance redressal facility on the portal.

How to Avoid Income Tax Refund Delays in the Future

Experienced taxpayers usually follow a few simple habits:

- Match income details with Form 26AS and AIS before filing

- E-verify the return immediately after submission

- Use a pre-validated bank account

- Respond promptly to notices or demands

These steps significantly reduce refund delays year after year.

Conclusion

An income tax refund delay can be frustrating, but in most cases, it is procedural and fixable. Understanding the reasons, checking refund status correctly, and taking timely action can resolve the issue smoothly.

As tax filing becomes increasingly digital, staying informed and proactive is the best way to ensure faster refunds and stress-free compliance.

Frequently Asked Questions

1. Why is my income tax refund delayed after e-verification?

Most refunds are delayed because the return is still under processing, or there is a mismatch in Form 16, Form 26AS or AIS. Bank account validation issues and pending tax demands can also stop refund credit.

2. How many days does it take to get an income tax refund after e-verification?

In normal cases, refunds are issued within 2–6 weeks after e-verification. However, during peak filing periods or scrutiny cases, the timeline can extend.

3. How do I check my income tax refund status online?

Log in to the Income Tax e-Filing portal → e-File → Income Tax Returns → View Filed Returns → Refund Status. The status will show if the refund is processed, pending or failed.

4. What should I do if my income tax refund is pending for a long time?

Make sure your return is e-verified, your bank account is pre-validated and linked with PAN, and there are no pending tax demands or notices. If the delay exceeds 45 days, file a grievance through the portal.

5. Can outstanding tax dues affect my income tax refund?

Yes. If you have unpaid tax dues from previous years, the department can adjust your refund against those dues, causing a reduced refund or delay.

6. Does the Income Tax Department pay interest on delayed refunds?

Yes. If the refund is delayed beyond the standard processing time and the delay is from the department’s side, interest is payable under Section 244A of the Income Tax Act.

Disclaimer

This article is for informational purposes only and does not constitute professional tax or legal advice.

Want clear, experience-based explanations on taxes, finance, and the economy?

Explore more practical guides on Arthneeti Global