How to Manage Monthly Salary Effectively: A Practical Guide

Every month, salary gets credited — and yet, by the last week, money feels tight. If this sounds familiar, you’re not alone. Millions of people experience the same struggle, even with a stable income.

Table of Contents

The truth is simple: the challenge is rarely how much you earn — but how you manage what you earn.

Good salary management doesn’t require complicated formulas, financial degrees, or strict restrictions. It begins with clarity, awareness, and consistent small habits.

This guide explains how to manage monthly salary effectively in a practical, stress-free, and realistic way that anyone can follow.

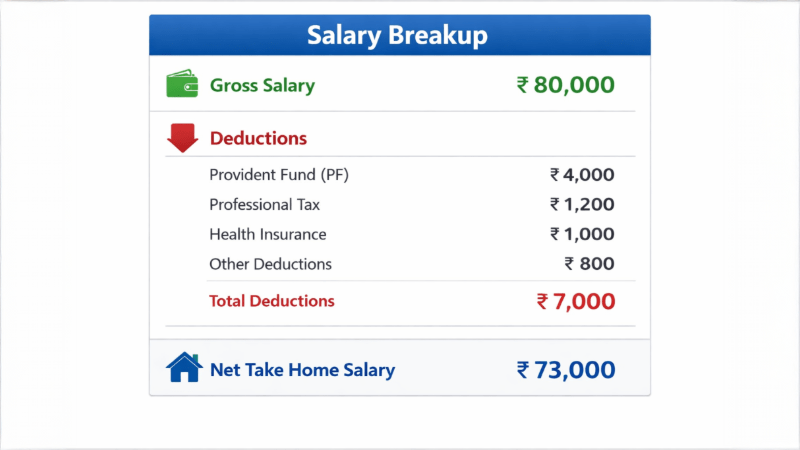

1️⃣ Know Your Real Take-Home Salary

Most people calculate life expenses on the CTC mentioned in job letters — not on what actually comes into the bank.

Your journey to managing money begins with understanding your true spendable income after deductions such as:

- Income tax

- PF contributions

- Professional tax

- Insurance premiums

When you plan with accurate numbers, budgeting becomes more effective and achievable.

2️⃣ Track Where Your Money Really Goes

Most people think they know their expenses — until they actually check. Small unnoticed costs add up fast.

Start by observing your spending pattern and divide it into:

✔ Fixed expenses

Rent, EMIs, school fees, insurance

✔ Variable expenses

Groceries, electricity, fuel

✔ Optional expenses

Snacks, online shopping, travel, entertainment

This simple awareness reduces financial stress and leads to smarter decisions.

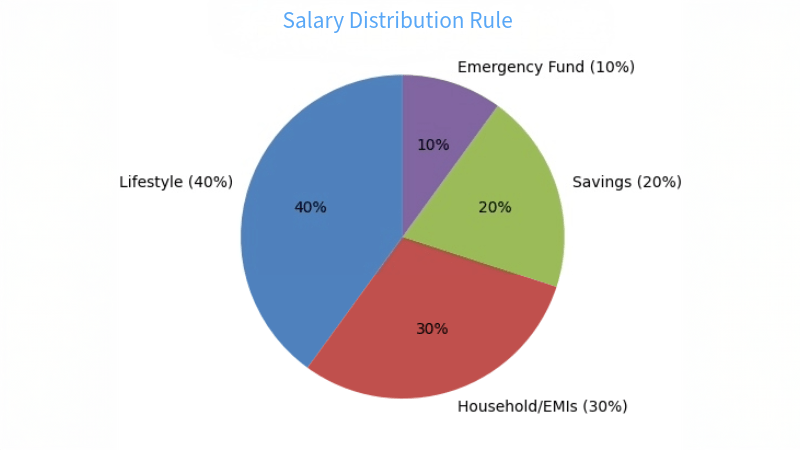

3️⃣ Create a Simple Monthly Budget System

You don’t need complicated spreadsheets or apps. Just a practical planning structure.

One of the most popular systems is the:

50-30-20 Rule

- 50% – Needs

- 30% – Wants

- 20% – Savings

You may also prefer:

40-30-20-10 Rule

- 40% – Lifestyle

- 30% – Household / EMIs

- 20% – Savings

- 10% – Emergency fund

There is no universal rule — choose what suits your lifestyle. The goal is to decide your spending in advance.

4️⃣ Prioritise Saving Before Spending

The biggest financial mistake people make is:

Spend first → Save later

The powerful alternative is:

Save first → Spend later

Even saving Rs -1,000 or 2,000 monthly builds discipline and long-term stability.

Start small — your habit matters more than the number.

5️⃣ Build an Emergency Fund

Unexpected expenses can shake financial stability and lead to debt.

Create an emergency fund equal to 3–6 months’ expenses to handle:

- Medical issues

- Job loss

- Repairs

- Sudden bills

It protects you emotionally and financially.

6️⃣ Avoid Lifestyle Inflation

When income increases, lifestyle automatically expands — often too quickly.

Better phones, better restaurants, more travel…

Enjoying life is important, but avoid spending faster than you earn.

A smarter mindset:

Upgrade slowly — save aggressively.

7️⃣ Review & Adjust Every Month

Managing salary is not a one-time activity. It requires monthly check-ins. Spend 10–15 minutes reviewing:

- Savings progress

- Overspending areas

- New priorities

- Goals

Small monthly changes prevent big mistakes.

💡 Expert Tip

If you’re serious about monthly salary management, also track:

- Total net worth

- Credit score

- Monthly debt ratio

- Subscription list

- Financial goals

These indicators show the full picture of money health.

❓ Frequently asked Question

Q1: How much of my salary should I save every month?

Ideally 20% or more. But even saving a smaller fixed amount builds long-term habit and stability.

Q2: What is the best method to manage monthly salary?

A simple budgeting rule like 50-30-20, along with salary tracking, automatic savings, and monthly reviews.

Q3: How do I control unnecessary expenses?

Track spending weekly, avoid impulse purchases, limit UPI payments, review subscriptions, and set monthly caps.

Q4: What should be my first financial priority?

Emergency fund + savings habit. Both protect you from debt and build confidence.

Q5: Can budgeting work even with low income?

Absolutely. Budgeting is about clarity, not salary size. Even small income benefits from structure.

⭐ Final Thoughts

Learning how to manage monthly salary effectively is not about perfection or strict rules.

It is about:

- awareness

- confidence

- small daily decisions

- long-term consistency

These habits build stronger control over money, reduce stress, and improve financial freedom over time.

At Arthneeti Global, our mission is to make financial learning practical, simple, and meaningful.

👉 Follow Arthneeti Global for more content on personal finance, investing, markets, and money mindset.

⚠️ Disclaimer

This article is for educational purposes only and should not be considered financial or investment advice.