Why Do FIIs Sell in the Indian Stock Market? Complete Analysis for Investors

Foreign Institutional Investors (FIIs) play a major role in shaping trends in the Indian stock market. When FIIs invest heavily, markets usually rise faster. But when they start selling, markets often turn volatile and retail investors become nervous.

Many investors wonder about why do FIIs sell in the Indian stock market even when India’s economy is growing? The answer lies not only in domestic factors, but also in global money movement, interest rates, and risk management strategies followed by large funds.

This article explains the real reasons behind FII selling, its impact on Indian markets, and what long-term investors should understand during such phases.

Why Do FIIs Sell Indian Stocks? Quick Answer

FIIs usually sell Indian stocks due to a combination of global financial conditions and domestic market factors, such as:

- Better risk-free returns in developed markets compared to emerging markets like India

- Rising US interest rates and bond yields, making bonds more attractive than equities

- Profit booking after strong rallies in Indian stock markets

- Global risk events such as inflation, wars, or recession fears that push funds to safer assets

Let’s now understand how each of these global and domestic factors influences FII investment decisions in detail.

What Are FIIs and Why Their Money Matters So Much

Foreign Institutional Investors (FIIs) are large overseas investors such as pension funds, hedge funds, mutual funds, and investment banks that invest in Indian stocks, bonds, and other financial assets.

Because FIIs invest very large amounts of capital, their buying or selling can significantly affect stock prices, sector trends, and overall market sentiment in India.

- Their buying increases market liquidity

- Their selling creates strong price pressure

- Index heavyweights are most affected by their trades

Even though domestic investors (DIIs) are now stronger, FII activity still influences short-term market direction significantly.

Domestic Reasons Why FIIs Sell in Indian Markets

High Market Valuations

When Indian stock markets trade at higher valuations compared to other countries, global investors may shift funds to cheaper or better-valued markets. FIIs continuously rebalance portfolios to maximize returns.

Profit Booking After Strong Rallies

After long market rallies, FIIs often book profits to protect gains. This is not negative news — it is part of normal portfolio management.

Corporate Earnings Slowdown

If company profits fail to grow as expected, FIIs may reduce exposure to avoid long-term underperformance.

Policy and Regulatory Uncertainty

Changes in taxation, sector regulations, or political uncertainty can temporarily reduce foreign investor confidence.

Global Factors That Drive FII Outflows From India

Global capital flows are heavily influenced by US monetary policy and bond market movements. Here’s how it affects India:

US Interest Rates and Bond Yields

When US bond yields rise, investors get safer and attractive returns from government bonds. As a result, money moves out of risky markets like equities and emerging economies.

Federal Reserve Policy Signals

Tight monetary policy reduces global liquidity. When borrowing becomes expensive, global funds reduce equity exposure and shift towards safer assets.

Strong US Dollar Effect

A strong dollar reduces returns for investors holding assets in weaker currencies. This increases currency risk and encourages capital withdrawal from emerging markets.

Global Risk-Off Sentiment

Events such as wars, banking crises, or recession fears push investors towards safer investments like US bonds and gold.

In short : FIIs don’t invest only based on India’s growth. They follow global risk and return cycles.

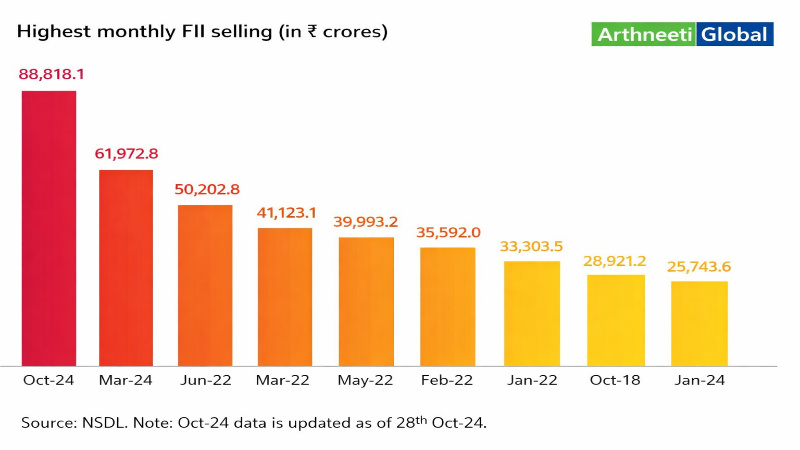

Recent FIIs Selling in Indian Stock Markets

To understand the impact of global and domestic factors, let’s look at how much money Foreign Institutional Investors (FIIs) have actually withdrawn from Indian equities in recent months. This data highlights how sensitive global capital is to interest rates, bond yields, and risk sentiment.

As seen above, FII selling has remained elevated over the past several months, reflecting investor preference for safer global assets. Periods of higher US bond yields and strong dollar strength usually coincide with stronger selling pressure in emerging markets like India. However, such outflows are often cyclical and tends to reverse when global liquidity conditions improve.

How FII Selling Affects Indian Stock Markets

When FIIs sell aggressively:

- Market volatility increases

- Large-cap stocks face selling pressure

- Rupee may weaken due to capital outflows

- Banking and IT stocks are usually more affected

However, strong domestic investor participation often absorbs part of this selling and prevents deep market crashes.

Investors should also keep track of trading schedules and market holidays while planning entry or exit during volatile phases. You can check the full Stock Market Holiday List 2026

Does FII Selling Always Mean Market Crash?

No. FII selling does not always indicate an economic problem.

Many times it reflects:

- Global fund rebalancing

- Short-term risk reduction

- Shifts in asset allocation

Historically, FIIs have exited and re-entered Indian markets multiple times. Long-term investors who remained invested during volatility often benefited when flows returned.

What Should Retail Investors Do When FIIs Are Selling?

Instead of reacting emotionally, investors should follow disciplined strategies.

What to Do

- Continue SIPs in quality mutual funds

- Focus on strong business fundamentals

- Maintain portfolio diversification

- Keep emergency funds separate from investments

What to Avoid

- Panic selling during corrections

- Chasing short-term momentum stocks

- Over-leveraging through margin trading

FII flows should be seen as market indicators, not investment instructions.

FII vs DII: Who Supports Markets When Foreign Money Leaves?

Domestic Institutional Investors (DIIs) such as mutual funds, insurance companies, and EPFO have become strong stabilizers in Indian markets.

In recent years:

- SIP inflows provide consistent buying power

- Pension and insurance funds offer long-term support

- Retail participation has increased market depth

This structural strength reduces the long-term damage from foreign selling.

Key Signals Investors Should Track Along With FII Data

Instead of watching only daily FII numbers, investors should monitor:

- Global interest rate trends (Source: US Federal Reserve)

- Inflation data

- Corporate earnings growth

- Currency movements

- Central bank policy announcements

These indicators provide better long-term guidance than daily flow numbers.

Investors can also track official FIIs flow data from sources like NSDL and NSE India for updated figures.

Conclusion

FII selling in the Indian stock market is driven by a mix of global financial cycles and domestic market conditions. It does not always signal economic weakness, and in many cases, it reflects routine global portfolio adjustments. For long-term investors, understanding market cycles and staying disciplined is more important than reacting to short-term capital movements.

Understanding how global money flows is essential for smart investing, and Arthneeti Global will continue to track the economic trends that shape Indian market

FAQs

Why do FIIs sell even when the Indian economy is strong?

FIIs invest based on global risk–return comparisons. Even if India’s economy is strong, higher interest rates, bond yields, or safer returns in developed markets like the US can attract foreign money away from emerging markets like India.

Does FIIs selling always mean the market will crash?

No. FII selling can cause short-term volatility, but it does not always lead to a market crash. Strong domestic institutional investors (DIIs) and retail participation can absorb selling pressure and stabilize the market.

How does US Federal Reserve policy affect FII investment in India?

When the US Federal Reserve raises interest rates or signals tight monetary policy, US bond yields become more attractive. This encourages FIIs to move money from riskier markets to safer US assets, leading to outflows from India.

Are FIIs more important than DIIs in Indian stock markets?

Earlier, FIIs had more influence, but today DIIs play a strong role. However, large FII movements can still impact market sentiment, liquidity, and index-heavy stocks in the short term.

What should retail investors do when FIIs are selling?

Retail investors should avoid panic selling. Long-term investors can use market corrections to invest in quality stocks through SIPs or staggered buying, rather than trying to time short-term market movements.

Can FII flows turn positive again quickly?

Yes. FII flows can reverse rapidly when global conditions improve, interest rates peak, or when emerging markets offer better growth prospects compared to developed economies.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be considered as financial or investment advice. Please consult a certified financial advisor before investing.

Pingback: Why Stock Market Falls: Key Reasons Explained Simply